Amazon has stated over and again that it wants to be THE place where shoppers can find anything being offered on the internet. It wants to go as far down the

long tail of selection/demand as it possibly can, offering products even in the deepest niches being purchased by the fewest customers.

The objective is clear: Amazon wants no excuses for shoppers to go to competitive sites to peruse potential purchases. And if Amazon can press its

growth levers to the extreme – offering the best convenience, the widest selection, and the lowest prices – why would shoppers even bother looking somewhere else? For that matter, why would they even bother running a Google search when they can just go straight to Amazon and save an extra step?

In short, Amazon wants to be ubiquitous.

Having the widest selection possible is crucial to achieving ubiquity. Amazon can offer a wider selection than Walmart by virtue of escaping the

tyranny of physical space. Well, mostly escaping that tyranny anyway. It can pack a wider selection into its 70 or so fulfillment centers than a traditional retailer could ever imagine stocking in its stores. But those warehouses – as big, efficient, and cheap to run as they may be – are still constrained by their four walls.

Third Party Sellers = Amazon’s Freedom from Tyranny of Physical Space

So Amazon turned to third party sellers to escape the confines of the four walls; to expand its item catalog. These sellers are a motley crew of merchants, ranging from established store-front retailers to product manufacturers; from grizzly wholesalers to small-time entrepreneurs. They bring their wares to this marketplace to gain access to some 200 million customer accounts Amazon offers. And, in return, Amazon gets to embellish its catalog with the additional selection, all of which comes at no direct inventory cost to the web giant.

This is the secret to pushing one’s selection far down the long tail of demand without running afoul the tyranny of physical space: let others source, stock, and ship the inventory for you.

It has been a booming business for Amazon.

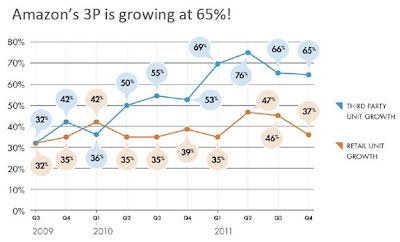

Scot Wingo, CEO of ChannelAdvisor – a business providing software and services to help these third parties organize their selling activities on Amazon, eBay and other marketplaces – writes an excellent blog about the Amazon retail business. It’s at

amazonstrategies.com, and I recommend it highly. Scot tracks the portion of Amazon’s overall unit sales that can be attributed to third parties. Amazon’s retail sales are growing at an impressive clip, and third party unit sales are growing even more quickly. As of the end of Amazon’s second fiscal quarter 2012, the company reported that 40 percent of all unit sales came from outside sellers.

(You can find the above chart

here.)

For the privilege of selling in its marketplace, Amazon takes an average toll of about 13 percent per transaction. Analysts estimate about 80 percent of that is gross margin. Not a bad business for Amazon to be in, especially considering how little investment it has to make (in terms of buying inventory and running the risks of it not selling quickly enough) to earn those margins.

As such, many observers have concluded that Amazon’s long-term goal is to expand this line of business; to keep growing its third party sales. That may be true. But as we’ll explore further below, there’s plenty of evidence that should give the sellers pause about tying their destiny to Amazon’s wagon with too tight a knot.

Platforms & Marketplaces…A Predictable Amazon Model

Part of what makes Amazon such an interesting company to follow is its tendency to find a premise that works and push it to an absurd extreme. So if you identify that premise, understand how the model works, it’s not unreasonable to extrapolate the pattern into the future. Despite its cloak of mystery, Amazon hides many of its secrets in the wide open.

For example, Amazon tends to cling to the following playbook as it grows its operating businesses (retail, digital media, web services):

Step 1. Create a base of customers. Offer something compelling (i.e., in high demand) at a low price point to bring the customers in. Once you earn their business, be fanatical about keeping them. This is where the price, selection, convenience growth levers come in, but it’s also about anticipating what customers want and innovating on their behalf.

Amazon treats this base of customers as its most valuable asset. And it is.

Step 2. Build a platform around these customers. For retail the platform is comprised of 70 fulfillment centers to store and process its inventory along with that of some third party sellers (those participating in “Fulfillment By Amazon”); the software and technology powering the familiar user interface and background functions with which we customers are so comfortable (customer reviews, 1-click checkout, quick search, etc.); and all the software and technology that runs in the background to let third parties add their items to the catalog, manage customer orders, and even use Amazon templates to build their own web stores.

Amazon makes the platform extensible and highly scalable. It’s built for growth, to always allow more customers to join in and also to welcome more sellers to the party. Its scalability means Amazon can continue offering access to it at lower prices as more players decide to participate.

Step 3. Establish a marketplace. The platform then powers a marketplace, that meeting place for sellers and buyers to swap money for goods. Amazon opens access to its most cherished asset (the customer base) provided sellers follow strict rules of engagement, all of which are designed for the benefit of customers. The rules tend to make products less expensive, services better, and delivery cheaper.

Step 4. Ruthlessly disintermediate middlemen and inefficiencies. Steps one through three tend to happen quickly as Amazon acts swiftly and cleans up the messes here in step four. It improves the operations of its fulfillment centers, allowing it to move a much higher volume of inventory for the same costs. It channels more work through its employees by building technology that makes many processes systematic or more efficient. Its employs a methodology by which it roots-out errors in the operations and fixes them at their core.

But, most significantly, it ruthlessly chases down and cuts out middlemen that slow things down or otherwise increase the cost of doing business. More on that in the next section…

The Amazon Credo & Disintermediation

We’ve talked about the

Amazon Credo before. It works like this:

The world is composed of three types of entities.

First, you have creators. They write books. They invent things. They code software. They record music. They program video games. They design and manufacture products. These people and entities are the basic unit of innovation and productivity in the world. They are to be empowered.

Next, you have customers, the consumers of the output from creators. They are the buyers, the readers, the end-users, the watchers, the listeners, and the players. They are the core asset of Amazon. They are to be invested in. They are to be defended.

Finally, you have middlemen. These are the people and entities that stand between the creators and customers. Oftentimes they have a purpose. But when they become gatekeepers that prevent access to the market by creators...or when they become toll-takers, charging fees to creators or customers in excess of the value they generate, they are the enemy of Amazon. They are to be disintermediated.

Amazon operates on a pretty straightforward credo. It goes something like this:

Fidelity to the customer; Fraternity with the creators; and Contempt for the Middlemen.

The problem becomes understanding what a middleman is. It’s a fungible concept to Amazon. The cherished partners of today are often the middlemen of tomorrow. There are all these shades of gray to deal with.

Let’s consider the third party sellers. A seller is not a seller is not a seller. Amazon wants to get as close to design and manufacturing source as it can. These are the creators, the originators, with which Amazon feels a certain fraternity. The marketplace-platform diagram might be better presented with this additional detail:

The sellers exist on a continuum, and the value of each is measured by how far removed it is from the original design and manufacturing of the product being sold. That source is the creation, and the further removed you are from the creator the more likely you are to be deemed a middleman. Maybe not quickly, but the closer Amazon can get to the source, the more danger you’re in of being disintermediated; of falling victim to step four in its playbook.

Let’s now consider the case of a third party seller being disintermediated.

The Threat…Competing Directly With Amazon

In July I wrote a post referencing a Wall Street Journal article by Greg Bensinger. (

See Amazon Sellers Competing with Amazon…On Amazon.) Greg featured an Amazon seller that specialized in NFL-theme pillow pets. His business had been building momentum, when all of a sudden Amazon started selling the exact same products for much, much less.

It’s no easy task competing with Amazon on Amazon. It’s a fool’s game.

Amazon, notoriously tight-lipped, does not comment on its business practices. But I think we can make some fair assumptions while Seattle remains quiet.

Even if it can charge the pillow pets seller a nice 13 percent commission for using the marketplace, Amazon’s average gross margin is about 23 percent. That means it stands to get a lot more cash per transaction from sourcing, storing, and selling items itself than by handing that off to third parties. Sure, it has all that overhead to pay for – it’s not cheap hiring buyers to source products – but when the teams are all ready in place (say, a toy buying group), you can leverage their operating efficiency. You can get more output from your overhead by folding more products, like pillow pets, into their selling mix. They can handle it.

But what about the inventory risk? Well, there’s not too much risk in sourcing and selling pillow pets when you’ve been able to watch how supply and demand play out by peaking into the performance of your third party partners.

What Sellers Are Safe from Distintermediation?

Amazon is striking a delicate balance here. It does want to grow its third party seller business. It’s the most efficient way to extend down that long tail of the demand curve; offering wider selection without taking the inventory risk in doing so.

But there’s more money to made working back toward the product originators on the seller continuum. The gross margins from direct sales are better than the commissions from third party sales.

It will be interesting to watch how Amazon manages the natural tension that exists between the desire for wider selection and the urge to get rid of the middleman and earn more profits.

After my post on the WSJ article, I got an interesting call from an Amazon third party seller. We bandied about thoughts about what sellers might be safe from Amazon stealing their business as it did to the pillow pets guy. How can you make sure you don’t get labeled a middleman? Here are a few of the conclusions we reached.

First, operate in a low-demand product line with low margins. Amazon has only so many resources to put into its growth. It must prioritize, and so it goes for the biggest bang for its buck. It wants items that move quickly off its shelves and create cash from customers before Amazon has to pay the bill to the originator.

To be able to operate a low-demand, low-margin business, you must be doing something right. Third party sellers who can do this likely have some edge that is hard for Amazon to disintermediate. They’re probably safe.

Second, operate in products outside the scope of Amazon’s current in-house merchant operations. If Amazon has a store through which it sources and sells inventory directly, the infrastructure is in place for it to expand that in-house merchandise selection. I’ll bet top dollar that Amazon consistently trolls its third party seller data to see what low hanging fruit is ripe for plucking; what items show enough demand and enough margin for Amazon to take it internal.

Third, sell products to which you have some sort of protected access to the originator; products that Amazon can’t easily procure. When Amazon can step in between you and your supplier, it will. If you have your supplier locked-up with exclusivity, because of material scarcity, or some form of business arrangement, Amazon won’t be able to disintermediate you by going directly to the source.

Finally, sell products that require a high level of expertise and sophistication to merchandise them effectively. For most product categories, Amazon wants to apply technology to interpret the demand and satisfy it with the right supply at the right price. If the economics of your market make for high volatility in supply and demand that a computer can’t easily identify and programmatically address (in other words, it requires human skill and intelligence), Amazon is unlikely to operate very well in this market. Amazon likes markets in which it can fix problems with technology solutions rather than people expertise.

If You Have Stories to Share

The stories from the third party seller trenches are fascinating in and of themselves and illuminating of Amazon’s approach to growing its business. If you have good information to share, I’d love to hear it. You can contact me at

pauldryden@gmail.com. I will always honor confidentiality and will not share information that you want to withhold from readers of this web site.

.jpg)